Hawaii Real Property Tax Search

Honolulu Property Tax

... 2026 Delivery of Notices of Assessment. DOWNLOAD PDF NOTICE OF ASSESSMENT ... Real Property Home Exemptions. Real Property Assessment Division. Search. Info.

https://realproperty.honolulu.gov/Hawai’i County Tax Rates – County of Hawaiʻi Real Property Tax Office

Real Property Tax rates are set annually by the Hawai’i County Council on or before June 20 preceding the tax year for which property tax revenues are to be raised. This is per the Hawai’i County Code, Chapter 19, Article 11, Section 19-90.

https://hawaiipropertytax.com/hawaii-county-tax-rates/

Honolulu Real Property Tax Payments

Your parcel ID / TMK number can be found on your real property tax bill received in the mail. ... Copyright 2021-2026. Tell us about your ...

https://pay.ehawaii.gov/hnl#!/search/11New Owner Information – County of Hawaiʻi Real Property Tax Office

- Notify the Real Property Tax Office any time your mailing address has changed since you signed the deed and conveyance tax certificate (these are filed and/or recorded with the State of Hawai’i Bureau of Conveyances) - Many times you have noted the mailing address prior to your move to the property or being assigned a PO Box #.

https://hawaiipropertytax.com/new-owner-information/

Understanding Your Oahu Real Property Assessment Notice Locations

Real property assessment notices will be hitting mailboxes soon, and if you've got questions, you're not alone. Below are answers to the most common questions Oahu homeowners have about how real property assessments are determined, how to appeal your home's assessment and more.

https://www.locationshawaii.com/news/local-news/understanding-your-oahu-real-property-assessment-notice/

Department of Taxation State of Hawaii

How Can We Help Important Resources News and Announcements Recent Updates - Rental Collection Agreement Persons authorized under agreements to collect rent (third party rent collectors) on behalf of owners of real property and transient accommodations located within Hawaii are required to file Form RCA-1 electronically.

https://tax.hawaii.gov/

Grossly Over-Assessed Honolulu Property Taxes

When property owners receive their assessment notice this month for 2026/2027, they should review it closely. If they think it might be over ...

https://www.hawaiilife.com/blog/grossly-over-assessed-honolulu-property-taxes/Hawaii Property Taxes Rates for Maui, Honolulu, Kauai, and Big Island

Hawaii Property Taxes Tax rates are always of big concern when looking for properties, understandably so, as a high rate could make a home otherwise no longer affordable. Hawaii has one of the lowest five property taxes for homeowners in the US - ask us about current property tax rates.

https://www.hawaiirealestatesearch.com/property-taxes

RPAD - FAQ

FAQ LEGAL DISCLAIMER The responses given within the FAQ's are not legal or professional advice. The Real Property Assessment Division (RPAD) provides general information regarding real property tax assessments. Any persons with specific inquiries regarding ownership, real property tax law and the appraisal process are urged to consult with an attorney or appropriate professional.

https://realproperty.honolulu.gov/help-resources/faq/

Understanding Property Tax in Oahu for 2025-2026

Understanding Property Taxes on Oahu for 2025 - 2026 One of the more important factors you need to understand when buying a home in Hawaii is the property tax structure. It may be different from what you are used to, so we have outlined what you need to know below.

https://www.hiestates.com/blog/understanding-property-taxes-on-oahu/

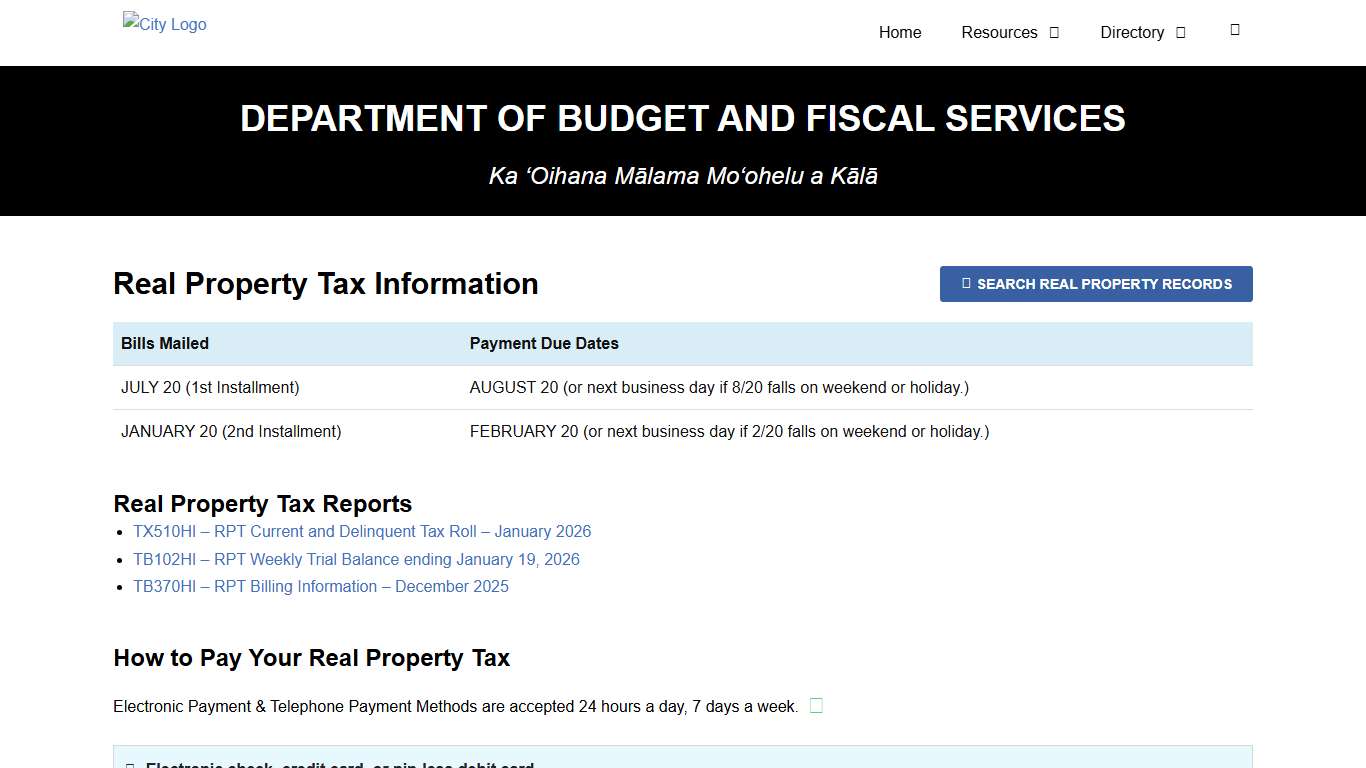

Treasury Division Department of Budget and Fiscal Services

How to Pay Your Real Property Tax Electronic check, credit card, or pin-less debit card Pay online or by telephone “AMOUNT DUE NOW” or “NEW BALANCE” or any amount. Pay Online: http://www.rphnlpay.com/ Pay via Telephone: 1-808-825-6819 A convenience fee will be charged by the service provider.

https://www.honolulu.gov/bfs/treasury-division/

Oahu Property Tax for 2025-2026

Oahu Property Tax for 2025-2026 If you own property on Oahu or are considering purchasing one, understanding the Honolulu County property tax system is essential. This blog post breaks down how property taxes work, key rates, exemptions, payment options, and important deadlines for the 2025-2026 fiscal year.

https://www.cathyhawaiihomes.com/blog/oahu-property-tax-for-2025-2026/

Hawai’i County Tax Rates – County of Hawaiʻi Real Property Tax Office

Real Property Tax rates are set annually by the Hawai’i County Council on or before June 20 preceding the tax year for which property tax revenues are to be raised. This is per the Hawai’i County Code, Chapter 19, Article 11, Section 19-90.

https://hawaiipropertytax.com/hawaii-county-tax-rates/

Maui Real Estate - The Smith Team - Coldwell Banker Island Properties

Maui homes For Sale - Haiku Homes For Sale - Haliimaile Homes For Sale - Hana Homes For Sale - Honokowai Homes For Sale - Kaanapali Homes For Sale - Kahakuloa Homes For Sale - Kahana Homes For Sale - Kahului Homes For Sale - Kanaio Homes For Sale - Kapalua Homes For Sale - Kaupo Homes For Sale - Keanae Homes For Sale - Keokea Homes For Sale -...

https://www.mauisales.com/blog-detail/understanding-maui-countys-real-property-tax-rates-for-2025-2026/

Maui Property Real Estate Tax 2026/2027

Understanding Maui's property tax system is crucial for buyers, sellers, and property owners alike. Whether you own a condo in Kihei, a single-family home in Lahaina, or vacant land in Upcountry, your tax classification and assessed value directly impact your annual costs.

https://www.mauiproperty.com/maui-property-tax-rates/

Maui County property tax rates 2025-2026 Georgie Hunter

Maui County Property Tax Rates Beginning July 1, 2025 this is the new property tax classification and rate sheet for the year going forward. Compared to last year, the tier pricing has changed, and some of the rates have increased, especially for those properties that are not owner occupied.

https://www.mauihunter.com/maui-county-property-tax-rates-updated-for-2025-2026/

Fiscal Year 2025-2026 1st installment Real Property Tax due Aug. 20 - Kauai County, HI

County officials would like to remind Kaua‘i property owners that the first installment of real property taxes for the 2025-2026 tax year is due on Wednesday, Aug. 20, 2025.

https://www.kauai.gov/County-Press-Releases/Fiscal-Year-2025-2026-1ST-installment-Real-Property-Tax-due-Aug.-20-2025